From Vine to Vein: San Juan's Mineral Wealth

Beyond the Malbec: Exploring the Province's Rich Mining Potential

San Juan, nestled in the shadow of Argentina's famed wine region, Mendoza, offers more than just robust red Malbecs. While Mendoza has recently captured attention for its mining prospects and development – as highlighted in the Financial Times article "Argentina's wine heartland eyes copper riches"1 it's crucial to recognize that Argentina's vinicultural and mineral wealth extends far beyond its most celebrated province.

Hold my glas indeed! While Mendoza certainly boasts exceptional bodegas, Argentina's diverse landscape yields a delightful blend of wines. Picture this: you could be sampling fine Pinot Noirs in Patagonia, perhaps even in company of playful penguins2. Or imagine savoring the aromatic Torrontes of Cafayate, a region renowned for its rich white wines, while other grapes ripe at high altitude. And then there's Mendoza's often-overlooked sibling, San Juan. Unlike some Mendoza vineyards, you're less likely to encounter nodding donkey pump here. Interestingly, while the FT article points to regulatory hurdles for mining in Mendoza, other Argentine regions present a more welcoming landscape for mineral exploration.

In fact, the northern provinces of San Juan, La Rioja, Catamarca, Salta, and Jujuy have been increasingly making headlines regarding mining news. The latter three, in particular, have been buzzing with the lithium hype surrounding the famed "lithium triangle".

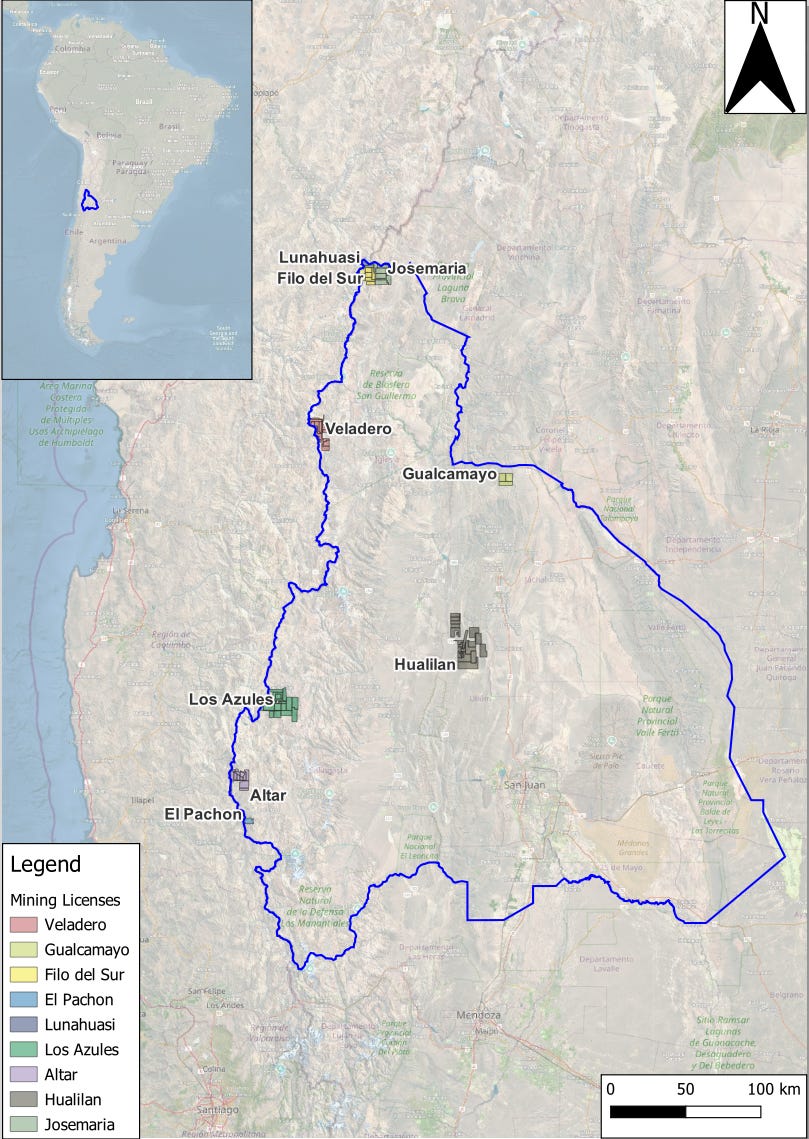

This brings me to the heart of the matter: San Juan's thriving mining industry. The province has a high level of activities driven by numerous (junior) mining companies. The recent significant deal between Lundin and BHP3 concerning the promising Josemaria and Filo del Sol projects has certainly generated considerable media attention4.

It's important to understand the regulatory landscape. Argentina operates under a federal system, meaning that while the national government establishes the overarching legal framework for mining, the provincial governments hold the reins when it comes to on-the-ground administration. Provinces like San Juan wield significant authority in granting mining concessions and permits, overseeing environmental compliance, collecting royalties, and enforcing regulations – all managed by the provincial mining ministry, the Ministerio de Minería of San Juan province5.

Geology, of course, pays no heed to political borders. While the Andes Mountains hold even greater mineral wealth on the Chilean side, that's a fascinating topic for another exploration. Additional upside potential is in La Rioja province, just North of San Juan province.

The current favorable pricing environment for copper, gold, and silver is making new development projects more attractive. To capitalize on this, Argentina is promoting investment through the Régimen de Incentivo a las Grandes Inversiones (RIGI). This regime aims to attract large-scale investment by offering key benefits such as tax stability, fiscal incentives (including reduced corporate income tax and import/export duty exemptions), and greater regulatory certainty.6

For now, let's focus on San Juan's current and potential mining powerhouses:

In production:

Gualamayo mine:

A gold and silver operation owned by Minas Argentinas S.A., which is part of the AISA Group7. Until 2018, the asset was owned by Yamana Grup8 before it was divested to AISA. Minas Argentinas is planning to revitalise the mine through the deep Carbonates would produce about 120 thousand ounces of gold annually for a minimum period of 17 years9, powering the mine by photovoltaic and selling surpluses to the grid10, and monetising high-quality limestone11. The company applied for RIGI back in November 202412

Veladero mine

A significant gold mine operated as a 50/50 joint venture between mining giants Barrick Gold and Shandong Gold13, with a production of around 505,000 ounces (on a 100% basis) in 202414

Discoveries, Pre-Feasibility/Feasibility, or Ongoing Development:

Josemaria & Filo del Sol

These adjacent copper, silver, and gold deposits are operated by Vicuña Corp, a 50/50 joint venture between Lundin Mining and BHP. Lundin's website describes them as world-class assets with substantial upside15. Josemaria16 is currently in a more advanced stage of development compared to Filo del Sol17. Interestingly, exploration licenses north of these significant projects are held by NGEx Minerals (in which the Lundin Group holds shares).

El Pachón:

This porphyry copper mine is owned by the global resources giant Glencore. Interestingly, information regarding this asset appears somewhat limited on their official website18

Los Helados and Lunahuasi Projects:

These neighboring projects highlight the cross-border geological potential of the region. Lunahuasi19, a copper-gold-silver prospect situated within San Juan, is wholly owned by NGEx Minerals. Just across the border in Chile lies the Los Helados copper-gold project, with NGEx Minerals holding a significant 69% stake alongside a 31% interest held by Nippon. This proximity underscores the interconnectedness of mineral belts, regardless of political lines.

Los Azules:

This is a substantial, high-grade open-pit copper-silver-gold project with an estimated mine life of 27 years, signaling a long-term operation. The project is under the ownership and operation of McEwen Copper Inc., a consortium backed by notable entities including McEwen Mining, Stellantis, Nuton/Rio Tinto Venture, Rob McEwen, the Victor Smorgon Group, and other shareholders20 The diverse ownership reflects the significant capital investment and potential of this large-scale undertaking.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022) and is being designed to be distinctly different from a conventional copper mine by consuming significantly less water, emitting much lower carbon, progressing towards carbon neutral by 2038, and being powered by 100% renewable electricity once in operation. The PEA published in June 2023 for the project estimates a $2.7 billion after-tax NPV8% at $3.75/lb Cu, a 27-year mine life, a copper resource of 10.9 billion pounds at grade 0.40% Cu (Indicated category) and an additional 26.7 billion pounds at grade 0.31% Cu (Inferred category).21

The mine will be powered by 100% renewable energy22, and company received approval of the Environmental Impact Assessment (EIA) in 202423. Back in February 2025, McEwen Copper applied for RIGI24. An illustrative video about the mine was released my the miner25.

Altar

The Altar copper-gold project is operated by Aldebaran Resources26 The depsosit comprises of Altar Central, Altar United, and Altar East porphyry centre. his significant deposit comprises three distinct porphyry centers: Altar Central, Altar United, and Altar East. Aldebaran is actively advancing the project, with a preliminary economic assessment (PEA) planned for 2025, followed by a pre-feasibility study (PFS) anticipated in 2026. These studies will provide crucial insights into the project's economic viability and potential development timeline.

Hualilan

This is a legacy gold-producing mine currently owned by Challenger Gold2728 The fact that it's a former producer sparks curiosity about its past yields and any potential for future resurgence, boosted by additional exploration drilling activities.

A Glimpse Beyond San Juan: La Mina La Mejicana

As mentioned before, it’s important to note that the mineral wealth of Argentina isn't confined to San Juan and Mendoza alone. Back in 2016, I had the opportunity to visit Mina La Mejicana, located near the town of Chilecito in La Rioja province. Beyond the region's wines, the engineering involved in accessing this mine is remarkable. A 35-kilometer cable car, constructed around the turn of the 20th century, ascends from Chilecito at 1,000 meters (above MSL) to approximately 4,500 meters (above MSL), supported by an astonishing 262 towers and nine stations - designed and built by British engineers. No suprise, it’s classified as an Argentine monument today. However, with the beginning of World War I the mine was shut down. This historical endeavor raises the intriguing question: could there still be gold waiting to be discovered in those high-altitude veins?

Final Thoughts: The Need for Accessible Data

On a concluding note, a significant challenge and opportunity lies in the vast amount of technical information generated by these projects. Consolidating this wealth of data – from historical reports to recent presentations – into a readily accessible database would be invaluable. Think of it as 'data mining,' quite literally, for insights into Argentina's rich mining potential. Such a resource would dramatically empower researchers, investors, and other stakeholders, providing a far more comprehensive picture than scattered individual documents. This isn't just a theoretical wish; modern mining companies, increasingly leveraging Machine Learning and Artificial Intelligence, are actively engaged in digitizing precisely this kind of information to unlock new discoveries and optimize operations. Also cheaper geological and geophysical data acquisition through drones support exploration and development efforts.

Nugent, C. (2025, May 6). Argentina’s wine heartland eyes copper riches. Financial Times (FT). https://www.ft.com/content/153d4a89-0856-4606-9cca-efb7afabf6c8

Moseley-Williams, S. (2022, Jan 3). In the World’s Southernmost Wine Region, Tasting Local Pinot Noirs Beside Penguins. Condé Nast Traveler. https://www.cntraveler.com/story/in-the-worlds-southernmost-wine-region-tasting-local-pinot-noirs-beside-penguins

Vicuña is born: the new joint venture of BHP and Lundin Mining (2025, Jan 16). https://vicuna.com/en/nace-vicuna-la-nueva-empresa-conjunta-de-bhp-y-lundin-mining/

Lundin Mining Announces Initial Mineral Resource at Filo Del Sol Demonstrating One of the World's Largest Copper, Gold, and Silver Resources (2025, May 4). https://lundinmining.com/news/lundin-mining-announces-initial-mineral-resource-a-123197/

San Juan: Ministerio de Minería https://mineria.sanjuan.gob.ar/

Argentinian government: Régimen de Incentivo para Grandes Inversiones (RIGI) https://www.argentina.gob.ar/noticias/rigi-desde-hoy-las-empresas-podran-aplicar-al-regimen

Website Aisa Group: https://www.aisagroup.ca/en/mineria

Yamana Gold announces ales of Gualcamayo mine https://econojournal.com.ar/2018/10/yamana-anuncio-la-venta-de-la-mina-de-oro-gualcamayo/

The Deep Carbonates Project at Gualcamayo Mine https://minasargentinas.com/en/gualcamayo/deep-carbonate-project

Photovoltaic Project at Gualcamayo Mine https://minasargentinas.com/en/gualcamayo/proyecto-fotovoltaico

Industrial Lime Production at Gualcamayo Mine https://minasargentinas.com/en/gualcamayo/producci%C3%B3n-de-cales-industriales

Minas Argentinas presents a USD 1,000 million plan to the RIGI at Guacamayo Mine https://minasargentinas.com/en/news/minas-argentinas-presenta-plan-de-usd-1000-m-al-rigi

Technical Report on the Valdero Mine, San Juan Province, Argentina. NI 43-101 Report (2018) https://s25.q4cdn.com/322814910/files/doc_downloads/operations/veladero/veladero-03232018.pdf

Barrick Annual Report 2024. https://s25.q4cdn.com/322814910/files/doc_financial/annual_reports/2024/Barrick_Annual_Report_2024.pdf

Lundin Mining. Disciplined Copper Growth at Scale. Corporate Presentation (2025 May). https://d2hw5o33fpk7z8.cloudfront.net/assets/files/9451/lundinmining_corporate_presentation_website_may25.pdf

NI 43-101 Technical Report, Feasibility Study for the Josemaria Copper-Gold Project, San Juan Province, Argentina (2020, Nov). https://d2hw5o33fpk7z8.cloudfront.net/assets/files/9391/josemaria_resources_technical_report.pdf

NI 43-101 Filo del Sol Project, Technical Report, Updated Prefeasibility Study (2023, Feb 228). https://d2hw5o33fpk7z8.cloudfront.net/assets/files/9391/filo-del-sol-pfs-ni-43-101-technical-report-update-final.pdf

El Pachón Project. Glencore website. https://www.elpachon.com.ar/

NI 43-101 Technical Report on the Los Helados and Lunahuasi Projects, Chile and Argentina (2023, Dec 13). https://wp-ngexminerals-2024.s3.ca-central-1.amazonaws.com/media/2024/04/slr-ngex-los-helados-and-lunahuasi-ni-43-10-dec.pdf

NI 43-101 TECHNICAL REPORT PRELIMINARY ECONOMIC ASSESSMENT LOS AZULES COPPER PROJECT (2023, May 31). https://s21.q4cdn.com/390685383/files/technical_reports/los_azules/LosAzulesPEA_2023.pdf

100% Renewable Energy for Los Azules https://www.mcewenmining.com/investor-relations/press-releases/press-release-details/2024/100-Renewable-Energy-for-Los-Azules/default.aspx

McEwen Copper Secures Environmental Permit for Construction and Operation of Los Azules https://www.mcewenmining.com/investor-relations/press-releases/press-release-details/2024/McEwen-Copper-Secures-Environmental-Permit-for-Construction-and-Operation-of-Los-Azules/default.aspx

Los Azules Requests Admission to Argentina's Incentive Regime for Large Investments https://www.mcewenmining.com/investor-relations/press-releases/press-release-details/2025/Los-Azules-Requests-Admission-to-Argentinas-Incentive-Regime-for-Large-Investments/default.aspx

NI 43-101 Technical Report on SEDAR for Alta Mineral Resource Estimate (2024, Dec 31). https://wp-aldebaranresources-2023.s3.ca-central-1.amazonaws.com/media/2025/01/09162223/NI-43101-Technical-Report-on-Altars-Mineral-Resource-Estimate-2024.pdf

Independent Geologist’s Report on the Mineral Assets of Challenger Exploration Limited -El Guayabo Project & Hualilan Project (2019, May) .https://challengergold.com/wp-content/uploads/SRKConsultingsIndependentReportOnTheMineralAssetsOfChallengerExplorationLimitedMay19.pdf

Challenger Gold Limited Emerging Growth Conference (2024, May 29). https://api.investi.com.au/api/announcements/cel/c065b78d-090.pdf

Great article, Thomas! I didn't know about la Mejicana, looks like something I would visit on my holidays, too.

There are indeed lots of old mines all around the country, also often in places where no modern-day exploration took place (so far). In that context, it would be really useful to put this in a database with all available information. Would love to do some site visits in such places as well.