Germany's Grid Guardians: The Rise of BESS in Ancillary Services

Dive into the critical role of Battery Energy Storage Systems in maintaining grid frequency and beyond, unlocking new revenue streams in Germany's dynamic energy landscape.

When attending classes covering ancillary services in European power markets, I admit, I often thought it was a niche, almost "geeky" subject, primarily the domain of large utilities. A few years later, my perspective has shifted. Today, ancillary services are at the forefront of grid stability, and a new player – Battery Energy Storage Systems (BESS) – is rapidly redefining their landscape.

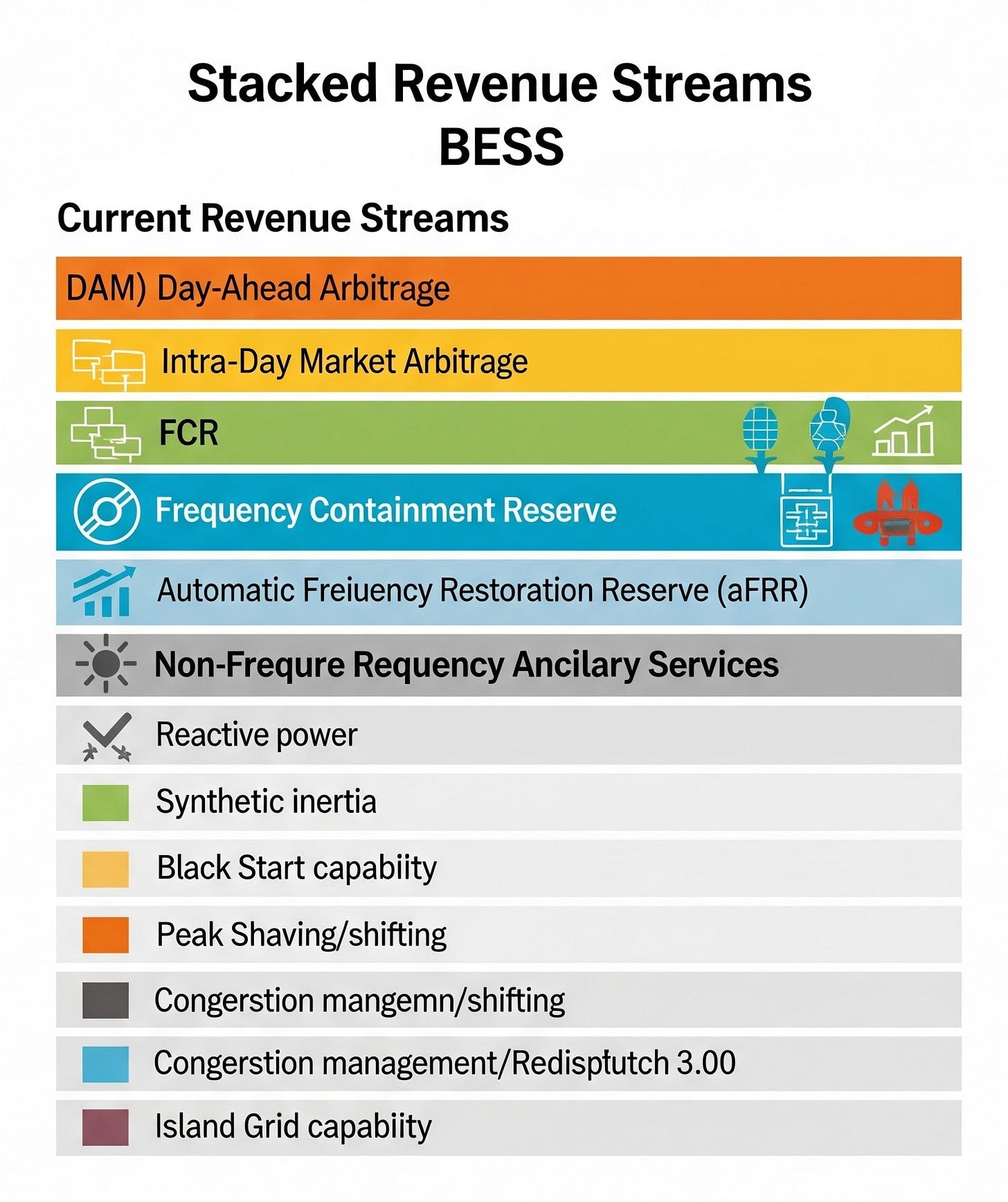

In earlier articles (see Investing into BESS1 and Stacking the Deck: Unlocking BESS Revenue Streams2), I’ve discussed the concept of stacked revenues for batteries. Beyond arbitrage opportunities on the Day-Ahead Market (DAM) and Intra-Day Markets (IDM), another crucial revenue stream for BESS lies in providing frequency ancillary services. These services are the unsung heroes that maintain the delicate balance of our electricity grid.

Understanding Ancillary Services: The Grid's Vital Functions

At its core, the European grid operates on a precise 50 Hz alternating current. This frequency is the heartbeat of the power system, and it must be maintained within an incredibly narrow operating band, typically between 49.8 Hz and 50.2 Hz. Any deviation signals an imbalance between electricity generation and consumption. A frequency above 50 Hz means there’s too much generation on the grid relative to the load, while a frequency below 50 Hz indicates the load is too high for the current generation. This fundamental principle explains why we have both "positive" and "negative" balancing services – either injecting additional power into the grid or reducing power to restore balance.

To illustrate the diverse roles that keep our grid stable, consider the various categories of ancillary services, as humoursly illustrated in Figure 1: Ancillary Services Overview. From ensuring frequency stability to providing voltage support and blackstart capabilities, these services are indispensable.

The Pillars of Frequency Regulation: FCR and aFRR

To maintain this delicate 50 Hz balance, transmission system operators (TSOs) rely on a hierarchy of frequency balancing services, each with distinct characteristics and activation times. These frequency responses are either automatically activated by specialized control systems or manually dispatched by the TSO to address grid imbalances. The two primary services for our discussion, and key opportunities for BESS, are Frequency Containment Reserve (FCR) and automatic Frequency Restoration Reserve (aFRR).

1. Frequency Containment Reserve (FCR): The Immediate Response

FCR is the grid's first line of defense. It's designed for rapid response, fully available within 30 seconds and capable of continuous activation for up to 15 minutes. This service is purely about capacity pricing (EUR/MW/block), meaning providers are paid simply for making the capacity available, regardless of actual energy delivered. It's a pay-as-clear auction, ensuring transparency and efficiency.

Germany's requirements for FCR capacity are substantial, typically ranging from 550 MW to 600 MW. While this sounds like a lot, the market is becoming increasingly competitive with the influx of new players. These services are typically auctioned in 4-hour blocks, resulting in six blocks per day, bid in 1 MW increments – similar to the Electricity Forward Agreement (EFA) system. What's neat is that these bids are submitted one day in advance. For a BESS operator, FCR (and aFRR) bids are often among the first to be submitted, even before engaging with Day-Ahead Market bids.

The evolution of FCR capacity prices in Germany can be seen in Figure 2: Daily FCR Capacity Price Range and Heatmaps.

The top chart shows the daily price range and moving averages, highlighting the volatility of the FCR market. We observe periods of relatively stable prices interspersed with significant price spikes. The heatmaps below, displaying prices by week and time block for each year, offer a more granular view. Looking closely at the FCR 2022 heatmap, the prevalence of brighter yellow and green colors throughout many weeks and time blocks clearly indicates that 2022 saw significantly higher FCR prices compared to 2021, and arguably more sustained high prices than 2023. This is particularly noticeable in the early morning (0-4, 4-8) and morning (8-12) blocks. It's important to note that 2022 was a year marked by exceptionally high power prices across Europe, largely driven by the geopolitical turmoil stemming from the Russian invasion of Ukraine, which significantly impacted energy markets.

As for 2024 and 2025, the heatmaps suggest that FCR prices remain robust, particularly in the 12 PM to 4 PM time window during sunnier parts of the year. This might not be a coincidence, as this period often aligns with peak solar (PV) generation, which can introduce increased intermittency and thus a greater need for flexible balancing services.

The market for FCR is continually evolving. With more and more BESS units, some with capacities exceeding 100 MW, coming online, competition for this "FCR pie" is intensifying, potentially leading to more competitive prices over time. However, the increasing share of intermittent renewables in the generation mix implies a growing need for frequency balancing services in the future. This ongoing demand offers a promising outlook for BESS. A significant advantage for BESS providing FCR is the low utilization factor, meaning less frequent cycling and consequently, lower degradation of the battery cells.

2. automatic Frequency Restoration Reserve (aFRR): The Sustained Response

Stepping up from FCR, we have aFRR, which provides a more sustained response. It becomes available within 5 to 15 minutes, with a maximum activation time of 15 minutes. Unlike FCR, aFRR offers a dual remuneration structure: both capacity pricing (EUR/MW/h) for making the service available, and energy pricing (EUR/MWh) for the actual energy delivered during activation. This market is cleared on a pay-as-bid basis, with an aFRR pay-as-clear mechanism.

The pricing dynamics for aFRR, both positive and negative, are illustrated in Figure 3: Germany Average aFRR Capacity Price Data.

The top chart of Figure 3 highlights the average daily prices for both positive (green) and negative (red) aFRR, showing their often correlated, yet distinct, price spikes. Similar to FCR, 2022 and 2023 saw particularly high price volatility. The heatmaps below for positive and negative aFRR across 2021-2025 reveal detailed hourly and weekly patterns. Both 2022 and 2023 exhibit widespread higher prices (more yellow/green) compared to 2021, 2024, and 2025, indicating that these two years were particularly lucrative for aFRR providers. Please also note that the chart is in EUR/MW/h, and not EUR/MW/block (essentially one block are 4 hours).

The increasing number of BESS active in the German market has indeed intensified competition, influencing both FCR and aFRR prices. However, the critical role of aFRR in managing grid stability, especially with the growing penetration of variable renewable energy sources, means its demand remains robust.

The Bigger Picture: European Harmonization

These national markets are not isolated. There are broader European harmonization efforts aimed at integrating and optimizing balancing markets across the continent. This is leading to increased efficiency and enhanced security of supply. Key initiatives include the European FCR Cooperation3 for FCR, PICASSO4 for aFRR, and MARI5 for mFRR (manual Frequency Restoration Reserve, which also operates on a 5 to 15 minute timeframe with capacity and energy remuneration). Essentially, larger capacity reserves are typically engaged after mFRR, representing the next layer of balancing support. These collaborations streamline cross-border balancing and further integrate Europe's energy markets. In the context of Battery Energy Storage Systems, this evolving landscape presents future opportunities beyond FCR and aFRR; the mFRR market could also become a significant area for BESS participation, leveraging their flexibility and rapid response capabilities for even broader grid support.

Beyond Frequency: The Regulatory Push Towards a Holistic Grid

While frequency regulation (FCR, aFRR, mFRR) forms the immediate backbone of grid stability, the need for other vital ancillary services is growing, especially as our energy system integrates more variable renewable generation. Historically, many of these "non-frequency" services were often procured directly by Transmission System Operators (TSOs) and Distribution System Operators (DSOs) through bilateral agreements, a somewhat opaque and less competitive process.

However, a fundamental shift is underway, driven by core principles in EU electricity market regulation. The Directive (EU) 2019/944 on common rules for the internal market for electricity (recast)6, a cornerstone of the Clean Energy Package, explicitly mandates a move towards more transparent and market-based procurement of these essential non-frequency services. This is a game-changer, fostering a more level playing field and paving the way for new technologies and market participants, including Battery Energy Storage Systems.

Specifically, Article 40, paragraph 5, states that:

"Transmission system operators, subject to approval by the regulatory authority, or the regulatory authority itself, shall, in a transparent and participatory process that includes all relevant system users and the distribution system operators, establish the specifications for the non-frequency ancillary services. The specifications shall ensure the effective and non-discriminatory participation of all market participants, including market participants offering energy from renewable sources, market participants engaged in demand response, operators of energy storage facilities and market participants engaged in aggregation."

Furthermore, Article 40, paragraph 6, also specifies that:

"The regulatory framework shall ensure that transmission system operators are able to procure such services from providers of demand response or energy storage and shall promote the uptake of energy efficiency measures, where such services cost-effectively alleviate the need to upgrade or replace network infrastructure, in a transparent, non-discriminatory and market-based manner, unless the regulatory authority has assessed that the market-based provision of non-frequency ancillary services is economically not efficient and has granted a derogation."

These provisions are designed to unlock competition and harness innovative solutions for grid management. By mandating a market-based approach, the EU aims to enhance system security and efficiency, allowing flexible resources like demand response and energy storage to contribute their full potential.

In EU terminology, the term ‘non-frequency ancillary service’ is precisely defined as:

a service used by a transmission system operator or distribution system operator for steady state voltage control, fast reactive current injections, inertia for local grid stability, short-circuit current, black start capability and island operation capability.

Essential Non-Frequency Ancillary Services: A Deeper Dive

Beyond the immediate world of frequency regulation, these crucial non-frequency ancillary services ensure the overall health and resilience of the power system:

Reactive Power: Unlike active power (which performs work), reactive power is essential for maintaining stable voltage levels across the grid. Without adequate reactive power, voltages can fluctuate wildly, leading to equipment damage or even grid collapse. BESS, with their power electronics, can rapidly inject or absorb reactive power, offering a highly flexible and precise solution for voltage support.

(Synthetic) Inertia: Inertia refers to the inherent resistance of rotating masses (like traditional generators) to changes in speed, which helps to slow down frequency deviations immediately after a disturbance. As synchronous generators are replaced by inverter-based renewables (like solar and wind), the system's natural inertia decreases. BESS can provide "synthetic inertia" by rapidly adjusting their power output in response to frequency changes, mimicking the stabilizing effect of traditional generators.

Black Start Capability: In the rare but critical event of a widespread blackout, where large parts of the grid go dark, a "black start" is required to bring the system back online. This service involves the ability of certain generation units (or BESS) to start up independently without external power and then gradually re-energize the grid sections. BESS are excellent candidates for black start as they can provide immediate power without relying on external sources.

Island Grid Capability (Island Operation): This refers to the ability of a portion of the grid to disconnect from the main synchronous grid and operate independently, typically during a major fault or blackout scenario. Maintaining stable operation within this "island" requires precise balancing of generation and load. BESS are uniquely suited for this role, providing crucial stability and black start capabilities within an isolated network.

Peak Shaving / Shifting: While often discussed in the context of energy markets, peak shaving and shifting also function as a form of non-frequency ancillary service. By storing excess energy during off-peak hours and discharging it during periods of high demand (peaks), BESS can reduce strain on the grid, defer costly network upgrades, and alleviate potential congestion.

Congestion Management / Redispatch 3.0: Transmission grid congestion occurs when the power flow on certain lines exceeds their capacity, often leading to inefficiencies or the need to curtail cheaper generation. Redispatch 3.0 is Germany's advanced regulatory and operational framework designed to manage and resolve grid congestion more efficiently. It includes new rules for forecasting, data exchange, and the activation of flexible assets like BESS. Strategically placed BESS can absorb power on one side of a congested line and inject it on the other, effectively acting as a "virtual transmission line" to alleviate bottlenecks and improve grid efficiency within this updated framework.

Spinning Reserve / Contingency Reserve: These services refer to generation capacity that is synchronized to the grid (spinning) or otherwise readily available to respond to sudden, unexpected events, such as the tripping of a large power plant or transmission line. They provide a quick injection of active power to prevent prolonged frequency dips or grid instability. BESS can contribute by holding a portion of their capacity in reserve, ready for immediate discharge. This concept is closely related to broader mechanisms like national Grid Reserves (e.g., Germany's Netzreserve) and Capacity Markets, all of which aim to ensure sufficient reliable resources are available to meet demand and maintain security of supply, often on a longer-term strategic basis.

The regulatory push for market-based procurement of these diverse non-frequency ancillary services, coupled with the inherent flexibility and rapid response of BESS, positions battery storage as a key enabler for the future, resilient, and decarbonized power grid. As these markets mature, they are poised to become additional, significant future revenue streams, allowing BESS to further diversify their earnings in this dynamic energy landscape beyond just FCR, aFRR, and energy arbitrage. Crucially, this diversification extends not only to standalone BESS but also to co-located Battery Energy Storage Systems combined with renewable energy assets (like wind and PV), offering further opportunities, see my recent article Beyond FiT: How Co-located PV & BESS Can Optimise Solar Revenue in Germany's Wholesale Market7. Realizing this potential, however, will require continued input from regulators, targeted legislative and policy changes, and a concerted joint effort between TSOs, DSOs, regulators, power producers, and BESS operators.

Investing into BESS

Renewable energy assets, such as wind and solar farms, are favored by investors due to their predictable revenue streams generated through long-term contracts like government-backed feed-in tariffs, PPAs or CfDs, and more. Battery energy storage systems (BESS) often complement these by storing excess renewable energy for later discharge, enhancing grid …

Stacking the Deck: Unlocking BESS Revenue Streams

Energy projects, particularly those involving capital-intensive ventures like LNG or renewables, often require substantial financing. While equity can be a source, debt is generally preferred due to its lower cost. However, securing debt for projects in illiquid markets can be challenging. To mitigate risks, lenders like banks often demand collateral, s…

FCR Cooperation: https://www.entsoe.eu/network_codes/eb/fcr/

Picasso website by ENTSOE: https://www.entsoe.eu/network_codes/eb/picasso/

Manually Activated Reserves Initiative (MARI): https://www.entsoe.eu/network_codes/eb/mari/

Directive (EU) 2019/944 https://eur-lex.europa.eu/eli/dir/2019/944/oj/eng

Beyond FiT: How Co-located PV & BESS Can Optimise Solar Revenue in Germany's Wholesale Market

The evolving landscape of electricity markets, particularly in regions with high renewable penetration like Germany, presents both challenges and opportunities for power producers. Understanding market dynamics, especially Day-Ahead (DA) pricing, is crucial for optimizing revenue streams. This article explores the potential revenue generation for a hypo…